In wake of demise of Duggan-Leonard-Theis No Fault insurance plan, lawmakers must make realistic, conscientious strides to lower premiums, preserve benefits

Michigan needs a No Fault insurance plan that will lower car insurance prices for drivers while preserving and protecting vital benefits and protections for car crash victims.

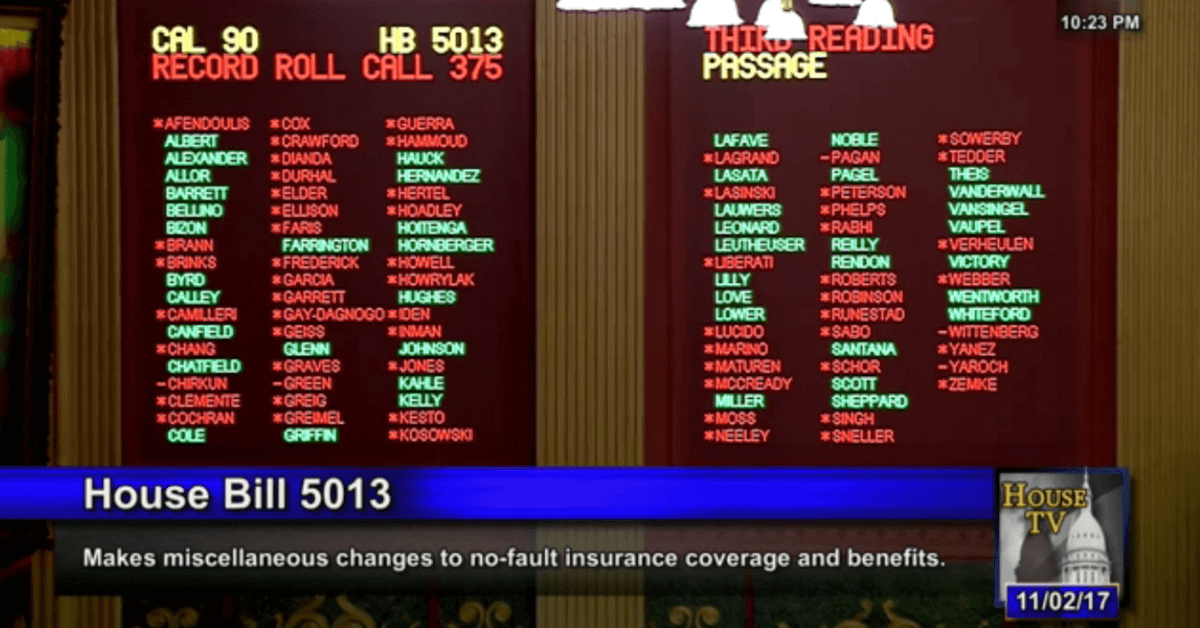

In a late night session in the Michigan House of Representatives, lawmakers decided on a 63-45 vote that House Bill 5013 — which was backed by Detroit Mayor Mike Duggan, House Speaker Tom Leonard (R-DeWitt) and House Insurance Committee Chair Lana Theis (R-Brighton) — was definitely not the No Fault insurance plan that would best serve Michigan drivers and car accident victims.

Below is the final “record roll call” on HB 5013:

In the many blog posts I’ve written about HB 5013 since its September 26, 2017, introduction — and rocket-like progress through the House Insurance Committee — I’ve brought attention to the significant and harmful flaws in the proposals:

- Duggan, Leonard No Fault PIP Cap is $25K — not the $250K they promise

- Duggan’s $25K No Fault PIP Choice Cap won’t cover medical, wages

- Duggan’s No Fault reform to slash family attendant care 66%

- So-called “savings” weren’t actually guaranteed

- Duggan-Leonard reform plan makes it tougher to collect overdue No Fault benefits

- Will Michigan doctors stop treating car accident victims?

- How insurers will be able to harass Michigan doctors

- Expect more denials and delays under Duggan No Fault plan

- Why Michigan No Fault reform bill HB 5013 is bad for your health

Going forward, I’m hoping that lawmakers will take yesterday’s vote as an indication that they need to steer away from those or similar proposals.

A package of No Fault bills sponsored by a broad, 44-member, bipartisan coalition of House lawmakers has been introduced and is awaiting a hearing before the House Insurance Committee.

It’s time for that hearing and for lawmakers to make realistic strides toward resolving once and for all Michigan’s persistent — albeit avoidable — crisis of ever-increasing, frequently unaffordable No Fault insurance prices.

And if there’s any lesson that politicians can learn from the demise of HB 5013, it’s that the public — and conscientious lawmakers — cannot be duped into believing that meaningful, long-term rate reductions are to be had by slashing benefits to car accident victims and erecting restrictions and legal hurdles whose sole purpose is to put more money into the pockets of Michigan car insurance companies.