Duggan-Leonard-Theis auto No Fault reform plan sets new hurdles for auto lawyers to prove owed No Fault PIP benefits are overdue; makes it harder for lawyers to sue and bring lawsuits for legally owed and overdue PIP benefits

The deeply flawed Duggan-Leonard-Theis No Fault reform plan — embodied in House Bill 5013 —makes it harder for car accident victims to recover promised and overdue, unpaid No Fault PIP benefits. It also makes it harder for the lawyers who represent these consumers to prove they are overdue, and makes it harder for these auto lawyers to prove that the benefits were wrongfully stopped as a result of an insurance denial or cut-off.

When it comes to separating car crash victims from their No Fault benefits and keeping them separated, this is the first part of the one-two punch delivered by Detroit Mayor Mike Duggan, House Speaker Tom Leonard (R-DeWitt) and House Insurance Committee Chair Lana Theis (R-Brighton) through their “Driver’s Choice Insurance Reform” plan. (The second part of that punch is how the plan makes it easier for Michigan auto insurers to deny and cut-off No Fault benefits to car crash victims, which I’ll discuss in an upcoming blog post.)

Unfortunately, this part of the plan has not received as much media scrutiny, buried as it is within the 78 pages of the bill.

What is Michigan’s current auto law on overdue, unpaid No Fault insurance benefits?

Under existing law, No Fault benefits are “overdue” if an auto insurance company doesn’t pay them within 30 days. (MCL 500.3142(2))

But auto insurers can and do push back by claiming the benefits are not overdue because they — the insurers — haven’t received “reasonable proof” of the “fact” and “amount” of the benefits that are being claimed. (MCL 500.3142(2))

Significantly, if a court determines that “overdue” No Fault benefits have been “unreasonably refused” or “unreasonably delayed,” then the auto insurer may be ordered to pay a “reasonable fee” to the auto accident victim’s lawyer. (MCL 500.3148(1))

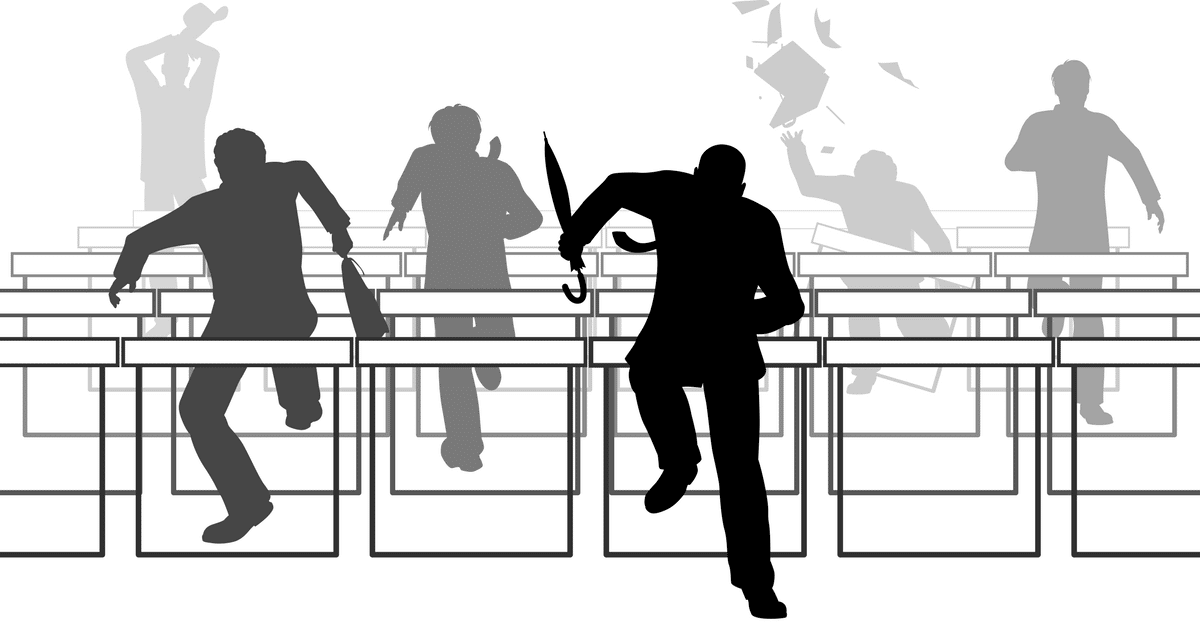

The Duggan-Leonard-Theis auto insurance reform plan in HB 5013 turns this time-tested system on its head, requiring car crash victims — and the lawyers who represent these car crash victims — to brave a legal minefield in order to recover No Fault benefits that are needed and rightfully and legally owed.

HB 5013 gives auto insurers more excuses for why No Fault PIP benefits are not overdue

HB 5013 gives auto insurers many more “excuses” for rationalizing and stonewalling why the No Fault benefits they’ve refused to pay are not technically “overdue.”

Indeed, the new roadblocks that insurers can throw in the path of car accident victims desperately in need of denied and/or cut-off benefits include the following the claims (HB 5013, Pages 45-46, 50-53):

- The charges for the claimed No Fault benefits don’t comply with the new Medicare-based fee schedule.

- The insurer hasn’t received “reasonable proof” of “all information” pertaining to the claimed No Fault benefits, which includes, but isn’t limited to: (a) Diagnoses. (b) Scans and x-rays. (c) Notes of physicians, nurses, and other providers. (d) Progress, psychiatric, or other notes. (e) Patient history and physical reports. (f) Reports and records relating to consultations, autopsies, operations, laboratory work, surgeries, recovery room activities, and electroencephalograms. (g) Incident, triage, and pharmacy reports and records. (h) Documentation relating to therapy, including, but not limited to, intravenous therapy, occupational or physical therapy, respiratory therapy, and speech therapy. (i) Documents relating to billing and forms and documents relating to the computation of charges and billing, including, but not limited to, Form CMS-1450, Form CMS-1500, and Form UB-04. (j) A determination of an emergency medical condition or related emergency care.

- The insurer hasn’t received “reasonable proof” — in the form of a doctor’s “specific written justification” — of the “medical necessity” of “a treatment, training, product, service, or accommodation that is not usually associated with, is materially longer in duration than, is materially more frequent than, or extends over a materially greater number of days than that treatment, training, product, service, or accommodation usually required for a patient with the diagnosis or condition of the” car accident victim.

- “[T]he insurer has reasonable proof that the insurer is not responsible” for payment of the claimed No Fault benefits.

Duggan-Leonard-Theis reform designed to make auto accident attorneys gun shy of helping car crash injury victims recover overdue, unpaid and legally owed No Fault PIP benefits

If the Duggan-Leonard-Theis No Fault car insurance reform plan becomes law, lawyers helping car crash victims recover overdue, unpaid No Fault benefits will have a lot — A LOT — more to worry about than convincing a court that the overdue benefits had been “unreasonably refused” or “unreasonably delayed.”

Under HB 5013, before an attorney can go to court to help a car accident victim recover overdue, unpaid No Fault benefits, he or she must (HB 5013, Pages 46-47):

- Notify “the resident agent of the insurer in writing that the payment for the claim is overdue …”

- Give the auto insurer “30 days” from receipt of “the notice” to “either provide reasonable proof that the insurer is not responsible for the payment or take remedial action.”

Of course, this introduces a whole host of excuses that insurers can exploit to stop a lawsuit for No Fault PIP benefits that they know are both legally owed and overdue, e.g., claiming notice wasn’t received, claiming notice wasn’t sufficient, arguing over what constitutes “reasonable proof” and/or “remedial action.”

But that’s just the beginning of the trouble that victims and their lawyers will face when they try to seek help through the courts.

Specifically, an auto accident victim could be forced to pay for “reasonable attorney fees” for the car insurance company if the insurer can convince a court of any of the following (HB 5013, Pages 47-48):

- The victim and his or her lawyer failed to abide by the notice/30-day waiting-period requirement.

- The claim for No Fault benefits pertains to medical treatment/care “that was not medically necessary or that was for an excessive amount.”

- The claim for No Fault benefits is submitted by a car crash victim who “was solicited by” his or her lawyer “in violation of the law of this state or the Michigan Rules of Professional Conduct.”

The point of these new restrictions is clear: Duggan-Leonard-Theis and their insurance industry backers want to make it as economically unfeasible as possible for auto insurance lawyers to help car crash victims receive the PIP benefits they are owed under Michigan law.

No savings, but lots of headaches and heartache under Duggan-Leonard car insurance reform plan

One irony of this flawed plan is that it likely won’t affect auto accident victims who had chosen the $25,000 cap.

That’s because the $25,000 No Fault cap is so easy for a car accident victim to blow through that it likely won’t last long enough for an insurer to get the chance to play games and deny people on valid and owed auto accident claims or to send these people to notorious cut-off doctors.

But for the automobile accident victims who either stuck with their unlimited No Fault plan or opted for the $500,000 cap under HB 5013, these pro-insurance company aspects of HB 5013 (no doubt actually written into the bill by insurance company lobbyists) are now doubly devastating.

Not only will the bill give insurance companies new opportunities to deny owed and overdue No Fault claims, but for the car crash victims now subjected to HB 5013’s clampdown on denied or owed and overdue claims, they will also be deprived of the “guaranteed” savings that the Duggan-Leonard-Theis No Fault reform plan. As House Insurance Committee Chair Lana Theis recently admitted, the so-called savings are only for the people who choose the $25,000 No Fault cap, and only for 5 years at that. After 5 years, auto insurers can go back to raising car insurance rates.

People who choose the $500,000 or unlimited No Fault cap will likely see no savings whatsoever.