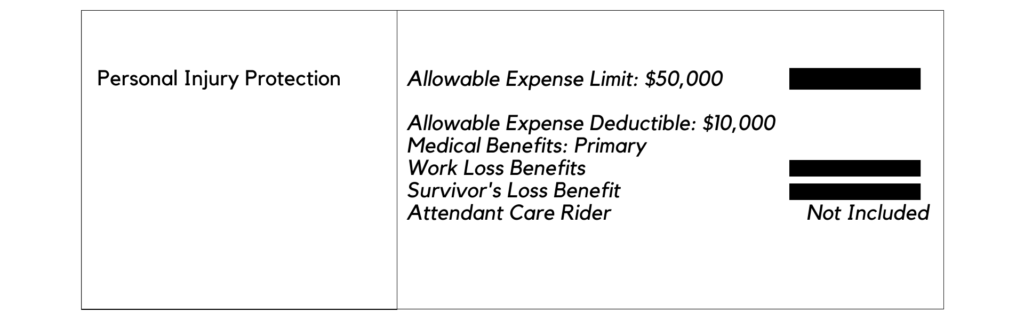

If your insurance agent offers to lower your auto premiums by having you purchase a $10,000 car insurance deductible on your Michigan No-Fault PIP coverage, just say no. What your agent is likely not telling you is that most of the people who are opting for this coverage are those who would also be most hurt by it. If you are injured in a serious car accident and you cannot afford to pay the full $10,000 deductible first, your insurer is off the hook and will pay $0 towards your medical bills, no matter how seriously you are hurt.

Your insurance company will not pay one penny towards your accident-related medical bills unless and until you pay all of the $10,000 Michigan No-Fault PIP car insurance deductible first.

I know we all want to save money on auto insurance. And I know auto No-Fault insurance remains terribly expensive in Michigan (I’ve written extensively on ways to meaningfully reduce the price of auto insurance as well). Insurance companies and agents know this too, which is why they came up with this product. But what this means is that if you cannot pay $10,000 Michigan No-Fault PIP car insurance deductible to your insurance company – after you have been seriously injured in an auto accident and you are likely too injured to return to work – then you will likely have to go without medical care altogether. In other words, this $10,000 is being deliberately targeted to the people who are least likely to be able to afford it if they actually do get involved in a serious car crash.

No one wants to think they will be the one involved in a crash. But many people who are buying this coverage will be involved in accidents and they will not have the financial means to pay the $10,000 deductible. That $10,000 deductible will be what stands between him or her getting the vital medical care that he or she desperately needs or being forced to go without it.

What is an insurance deductible?

An insurance deductible is the amount of money that you will have to pay out-of-pocket towards your claimed loss before your insurance company will start to pay under your insurance policy. Deductibles are offered as a way to reduce your premium, i.e., the higher your deductible, the less you pay on premium.

What is a deductible in car insurance?

A deductible in car insurance is the dollar amount that you agreed with your auto insurer to pay towards your Michigan No-Fault PIP medical benefits claim, your collision claim or your total loss claim before your insurer would step up and provide the coverage you paid for under your policy.

For example, if you have a Michigan No-Fault PIP medical car insurance deductible in your auto insurance policy and if you have been injured in a crash and you have received (and/or you are continuing to receive) medical care for your injuries, then your auto insurer will not pay any of your medical bills unless and until you have paid the full amount of your deductible.

What is the maximum No-Fault PIP insurance deductible allowed in Michigan?

There is no maximum. Michigan law sets no limits on how high auto insurers can set their No-Fault PIP medical deductibles. Before 2012, $300 was the maximum PIP deductible allowed and anything above that required “prior approval” by the Insurance Commissioner. In 2012, lawmakers eliminated both limitations.

Significantly, according to the House Fiscal Agency’s legislative analyses for Public Act 454 of 2012 – which changed Michigan’s law on No-Fault PIP deductibles – the $300 limit on No-Fault PIP deductibles was eliminated because a report from the Insurance and Finance Advisory Rules Committee (ARC) concluded the deductible cap was “arbitrary.” The same report also recommended eliminating the “prior approval of the commissioner” requirement for PIP deductibles.

As a result of the amendments in Public Act 454 of 2012, which took effect on December 27, 2012, Michigan’s law on No-Fault PIP deductibles (MCL 500.3109(3)) now reads:

“An insurer providing personal protection insurance benefits under this chapter may offer, at appropriately reduced premium rates, a deductible of a specified dollar amount. This deductible may be applicable to all or any specified types of personal protection insurance benefits, but shall apply only to benefits payable to the person named in the policy, his or her spouse, and any relative of either domiciled in the same household.”

What Michigan auto insurance companies offer a $10,000 No-Fault PIP insurance deductible?

We are aware of instances where both Allstate and AAA have offered $10,000 PIP deductibles to their insureds in Michigan. We suspect that there are more. Unfortunately, we expect this dangerous trend to continue as insurance companies convince drivers to jeopardize their access to medical care after a crash in the future for minimal, fleeting premium savings right now.

Why is a $10,000 No-Fault PIP car insurance deductible a terrible idea?

A $10,000 No-Fault PIP insurance deductible will result in a denial of access to necessary medical care for many car accident victims because most people who are buying this coverage will not be able to pay the $10,000 deductible. Without being able to pay this deductible first, which is a condition precedent to their insurance company then paying for necessary medical care and treatment, the insurance company escapes all responsibility to their insured to pay for their medical care and treatment.

As an auto accident lawyer, I can tell you firsthand that the insurance companies are not only well aware of this, but they are deliberately pushing this type of coverage on people who are least likely to afford it if they are involved in a car accident. They are making big promises of savings on car insurance, but they are doing it knowing this policy will save them tens of thousands of dollars, if not more, when these people are inevitably seriously injured on our roads but cannot meet their deductible.

It’s unconscionable. The consequences will be devastating for those who are least able to afford it. People with great private health insurance and substantial financial means are NOT the people that these $10,000 car insurance deductibles are being aimed at.

Can people afford to pay a $10,000 car insurance deductible for their No-Fault PIP medical benefits?

This type of high car insurance deductible policy is being targeted at many of the same people who would not be able to pay a $10,000 insurance deductible as a prerequisite to getting their medical bills paid by their auto insurer after being injured in a car accident. For many of the people who this coverage is being sold to, payment of the $10,000 deductible would likely wipe out much of their family’s savings.

The median bank or savings account balance in the U.S. is $5,300 and the average bank or savings account balance is $41,600, according to Bankrate (which relies on the most up-to-date data published by the Federal Reserve’s Survey of Consumer Finances). And millions of Americans are already woefully unprepared for retirement with inadequate private savings.

How could a $10,000 Micihigan PIP deductible deny access to medical care for crash victims?

A $10,000 Michigan No-Fault PIP medical car insurance deductible could jeopardize your access to medical care and treatment after you were injured in a car crash because if you cannot afford to pay the deductible, then your auto insurer will not pay for your medical expenses and, thus, you will not be able get the care you need.

Health insurance and Medicaid and Medicare are not necessarily available or reliable options as they may also involve deductibles, exclusions, and/or coordination clauses that preclude coverage until you have exhausted your No-Fault coverage.

I have a unique perspective on this as a truck accident attorney who has been asked by other attorneys to handle very serious truck accident cases in many “pure tort” states that do not have No-Fault. It is very important for people to understand that Medicaid will be completely inadequate for most serious injuries. This is why you so often hear the term “medical warehousing” for people with catastrophic medical injuries, such as traumatic brain injuries and spinal cord injuries, who do not have insurance to cover necessary care. This is what happens all over the country, and not with these $10,000 car insurance deductibles, it’s going to be happening here in Michigan more and more often for people who are seriously injured, unable to pay, and unable to then receive the critical medical care they require.

Below are some of the obstacles to getting medical care and treatment after being injured in a car accident if you cannot afford to pay a $10,000 Michigan No-Fault PIP car insurance deductible:

- Health insurance – Your health insurance plan may require you to pay a hefty car insurance deductible before the plan will begin to provide coverage for your medical care. It is not uncommon for many health insurance plans to have deductibles that range from $1,000-$5,000. Your health plan may provide that it is only a “secondary payer” and, thus, only pays after No-Fault has paid for medical care up to the coverage limits of the No-Fault policy. If your injuries in the crash prevent you from returning to work, you may lose your health coverage if it’s provided by your employer. Finally, if you have employer-provided health coverage through your employer’s self-funded ERISA plan, then any money that is paid out on your medical care may be reimbursed from any recovery you obtain for pain and suffering compensation from the at-fault driver.

- Medicaid and Medicare – You may run into issues such as: (1) whether you are eligible and/or qualify for benefits; (2) denial of coverage because Medicaid and Medicare are “secondary payers” under federal law and they will not pay for medical care when a driver’s auto No-Fault insurance is legally liable; and/or (3) liens on any third-party recovery for pain and suffering compensation to reimburse Medicaid or Medicare for what it paid out for your medical care and treatment.

Have questions? Call a Michigan Auto Law attorney for a free consultation

If you’re wondering whether it’s a good idea to agree to a $10,000 Michigan PIP medical car insurance deductible, then call us right away toll free anytime 24/7 at (800) 777-0028 for a free consultation with one of our experienced attorneys. We will answer your questions about No-Fault PIP medical deductibles, whether they are a good idea for you and your family, and if so what amounts you should negotiate for with your auto insurance company. We can also answer questions about your and your family’s legal rights to pain and suffering compensation, economic damages and auto No-Fault insurance benefits, and settlements in the event that you or a loved one is ever involved in a car accident. There is absolutely no cost or obligation. You can also get help from an experienced injury attorney by visiting our contact page or chat feature on our website.