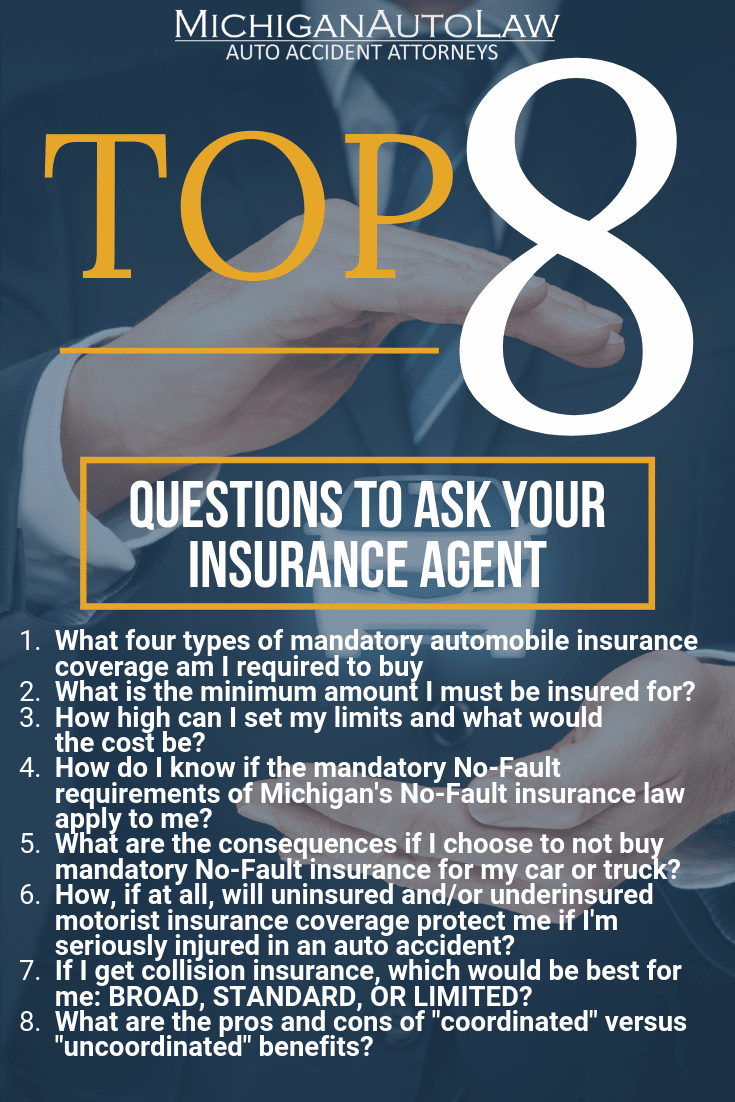

8 Questions To Ask When Getting Car Insurance in Michigan

A list of questions to ask when getting car insurance along with answers to help you understand your options and choose the policy to best protect you

We understand that buying car insurance in Michigan can be different because of it’s No-Fault laws which is why we’ve provided a list of 8 questions to ask when getting car insurance in Michigan below.

It’s very important that you understand the answers to the questions we provide below – and the answers your car insurance agent provides to you in-person – so you can learn about your options and get the coverage that can best protect you.

To get an idea of what to expect from your agent, here’s a video of Michigan Auto Law attorney Alison Duffy discussing the 8 questions to ask when buying car insurance in Michigan with independent agent Wendy Beever of the Dearborn Agency.

Top 8 Questions To Ask When Getting Car Insurance in Michigan

1. What four types of mandatory automobile insurance coverage am I required by law to buy?

This is a critical question to ask when getting car insurance because you want to make sure that you are purchasing policies that are required by law. When buying car insurance in Michigan you are to purchase the following coverage:

- Personal Injury Protection (PIP)

- Property Protection Insurance (PPI)

- Residual Bodily Injury Liability (BI)

- Property Damage (PD)

2. What is the minimum amount I must be insured for?

This is a great question to ask when getting car insurance as things are going to change with the new No-Fault law.Until the new No-Fault PIP medical benefits coverage levels become available after July 1, 2020, all drivers must purchase unlimited medical coverage as well as coverage for wage loss and replacement services.

Once the new coverage levels become available, drivers will have options. Drivers with Medicaid will be able to select a $50,000 medical coverage level and drivers with Medicare will be able to opt out of No-Fault PIP medical benefits altogether. Other drivers will choose from medical coverage levels of $250,000, $500,000 and “no limit.”

The limit for PPI benefits is $1 million and it is set by statute.

The minimum limits required by law for residual bodily injury liability coverage is currently $20,000 and $40,000 for bodily injury and/or death of one or 2 or more persons, respectively, in one car accident. However, after July 1, 2020, the minimum limits for BI coverage will increase to $250,000/$500,000, although drivers will be able to opt for lower minimum limit of $50,000/$100,000.

The minimum PD limit is $10,000.

3. How high can I set my limits and what would the cost be?

The coverage levels – and, thus, the limits – available for No-Fault PIP medical benefits are as discussed above.

The No-Fault imposes no maximum limit on residual bodily injury liability and property damage coverage. When buying car insurance drivers will have to discuss with their car insurance agent what maximum limits are available.

The No-Fault law sets the limit for PPI benefits at $1 million.

In terms of questions about costs, your car insurance agent will be able to discuss with you what your expected premiums will be depending on the coverage and coverage limits you select.

4. How do I know if the mandatory No-Fault requirements of Michigan’s No-Fault insurance law apply to me?

If you’re a Michigan resident, if you own a car and if you plan to drive it on Michigan’s roadways, then the No-Fault law applies to you: It requires you to obtain No-Fault car insurance.

5. What are the consequences if I choose to not buy mandatory No-Fault insurance for my car or truck?

They include any or all of the following:

- Jail time

- Fines between $200 and $500

- Being denied all No-Fault benefits to cover medical expenses and lost wages

- Being denied all pain and suffering compensation.

- Being denied recovery under the mini tort law.

- Being held financially liable for another driver’s medical expenses, lost wages and vehicle damage (Even if you (as the uninsured driver) were 100% innocent and the crash was caused by a speeding, texting, drugged and drunk driver, you (as the uninsured driver) could still be sued to pay for all of the at-fault driver’s accident-related medical expenses and lost wages – which could feasibly run into the millions of dollars.

6. How, if at all, will uninsured and/or underinsured motorist insurance coverage protect me if I’m seriously injured in an auto accident?

This is another vital question to ask when getting car insurance in Michigan. So, uninsured motorist (UM) coverage allows a car accident victim to recover pain and suffering damages in the event he or she is injured in a crash caused by an uninsured driver or hit-and-run driver

Similarly, underinsured motorist (UIM) coverage allows a car accident victim to recover pain and suffering damages in the event he or she is injured in a crash caused by an underinsured driver (i.e., a driver who has PLPD coverage (with minimum liability limits) or liability limits that are well below the pain and suffering damages the victim is entitled to.

In the wake of the new Michigan No-Fault insurance law with its limited coverage levels for No-Fault PIP medical benefits, UM and UIM coverage will provide car accident victims with a source for medical benefits when their accident-related medical expenses exceed their No-Fault PIP medical benefits coverage level AND the excess medical cannot be collected from the uninsured/underinsured driver.

7. If I get collision insurance, which would be best for me: broad, standard or limited?

In Michigan, both broad form and standard collision are the best. Why? Because both provide benefits and coverage regardless of fault, i.e., regardless of whether you or someone else caused the crash that resulted in your vehicle damage.

Limited collision coverage only pays out if the insured was not at-fault.

8. What are the pros and cons of “coordinated” versus “uncoordinated” benefits?

Another critical question to ask when getting car insurance. The differences between them are:

- Uncoordinated benefits – In Michigan, uncoordinated benefits are better because No-Fault is primary and No-Fault covers more in terms of care and services that car accident victims will need than private health insurance companies, such as residential and attendant care, hospitalization, rehab and vehicle and home modifications.

- Coordinated benefits – If insureds are lucky, they may see some reduction in their premium rates. However, they could face ERISA liens. Plus, private health insurance plans likely include some form of managed care, which includes doctor networks (no choice of doctor) and pre-authorization requirements for care, procedures and surgeries.